[Acknowledgemet: I’d like to thank the artist Samar Hejazi for taking the time to walk me through her experiences and reflections on Non-fungible Tokens (NFTs). You can check out her own NFT (shown above) here and the rest of her amazing work here.]

Chris Dixon, a VC partner at Andreessen-Horowitz, theorized that activity within the crypto space evolves in cycles driven by cryptocurrency prices:

These cycles appear chaotic but have an underlying order, roughly characterized as 1) the price of Bitcoin and other crypto assets goes up, 2) leading to new interest and social media activity, 3) leading to more people getting involved, contributing new ideas and code, 4) leading to projects and startups getting created, 5) leading to product launches that inspire more people, eventually culminating in the next cycle.

Dixon has shown in his analysis that when crypto prices plummet at the end of each cycle, total startup and development activity slows down though to a higher footing than before. Over time and across cycles, crypto innovation activity continues to rise.

It seems that we’re in the midst of a full swing “crypto price-innovation cycle”; the fourth cycle if we were to follow Dixon’s thesis. Bitcoin’s price is at historic highs ($59K at the time of writing), there’s a crypto euphoria that is infecting corporate America, and VC crypto-investing sentiment is buoyant.

Non-fungible Tokens (NFTs), the unique digital assets stored on blockchains, are joining the crypto boom party (“JPG File Sells for $69 Million”!!!).

[For some background on NFTs, check out this BBC article.]

So how will this NFT craze play out?

When cryptocurrency prices plummet, NFT trading goes anemic

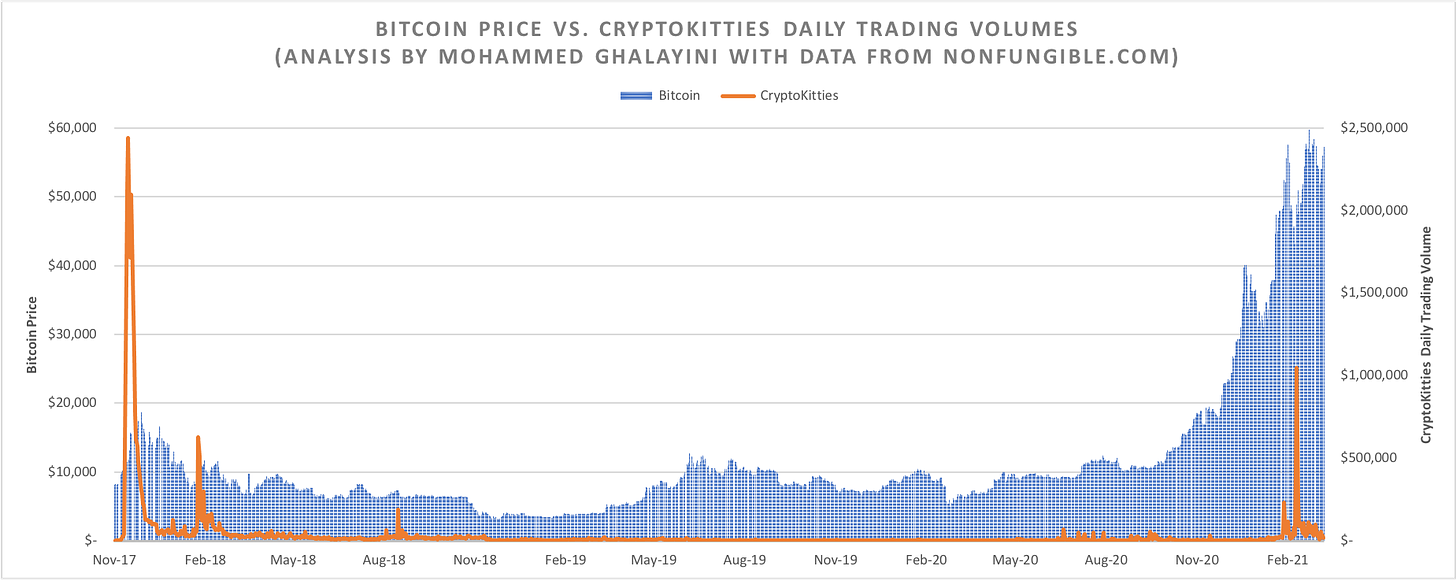

CryptoKitties, the unique and tradeable digital cats, are some of the first NFTs. They appeared on the scene in the thick of crypto’s “third cycle” – late 2017 – when bitcoin prices broke records. The reception was insane; within the span of two weeks, CryptoKitties’ daily dollar trading volumes increased by more than 380000%, hitting a $2.4M peak.

Once bitcoin’s price plummeted in 2018, CryptoKitties trading volumes entered a prolonged stasis. Until recently, daily trading volumes were under $25K for most of the past 3 years.

Cryptocurrency and NFT hypes go hand in hand. After all, most NFTs are bought and sold using cryptocurrencies. Convincing people to convert real dollars to digital cats required a certain heady atmosphere. These conditions were made possible by combining skyrocketing cryptocurrency prices, novelty, and viral “get-rich-quick” social-media stories.

Will cryptocurrencies plummet? It’s certainly entertaining to follow the two opposing camps of this debate; the Twitter barbs are hilarious. But expectations of a bursting bubble are mounting, even within certain crypto-enthusiast corners. Once this happens, NFT activity will drop significantly, possibly following CryptoKitties’ stasis journey. This will mean that people will lose money, many will abandon the concept of NFTs altogether, and the headlines and hashtags will move on to other topics.

A small-ish diehard group of NFT-enthusiasts will hold the fort, and as Dixon predicts, will set the stage for the next cycle.

Will NFTs “democratize” art?

There’s a lot of talk within the blockchain community on how the technology would democratize asset ownership and exchange. What does this exactly mean? Usually, it refers to the elimination of intermediaries. For example, bitcoin democratizes value exchange because people can directly transact without the need for a bank in the middle. This is also called decentralization, eliminating the need to authenticate and process transactions by central entities like banks or even governments.

Decentralization works well within bitcoin’s context since the asset is native to its blockchain: it’s generated and transacted within its system. But when it comes to digital art, creators have to upload their files and mint them into NFTs to enter the blockchain. Something from outside the blockchain has to enter into it. This presents what is called the gateway or oracle problem.

How do we make sure that NFT art entering the blockchain is authentic, original, and belongs to the artist? Well, the answer is simple, by introducing third-party validators. E.g. In the case of Beeple’s JPG that sold for $69M, Christie’s was the validator. The process of establishing authenticators and validators, basically platforms whose job is to establish artists’ identities and make sure what they submit is original, runs counter to the decentralization ethos. But it’s necessary to avoid hacks and frauds. If we project into the future, we can imagine a world full of trusted digital galleries and digital auction houses that act as the digital art world’s gatekeepers. Imagine digital Christie’s and Sotheby’s.

Hold on, so we’re replicating the real world’s art market?

But what about royalties? NFTs can add functionality to ensure that artists get perpetually paid. Sure, but as Benedict Evans observed: “you don’t need software for that.”

The oracle problem is real and is a limiting factor for when blockchain applications are joined to the real world.

The NFT art world, if it thrives, will end up resembling the art world we have today with all its hierarchies, connections, and gatekeepers.

The real thing?

There’s a lot of concentration within crypto. Close to 2% of bitcoin wallets own 95% of the currency3; these “whales” make the market and drive up prices. A similar concentration can be seen in Ethereum as well. It’s also true that the mysterious Metakovan was the one who bought Beeple’s JPG for $69M. Metakovan is a longtime crypto whale who happens to own an NFT company. Crypto and NFT markets are not driven by genuine retail-level interest.

Another display of concentrated market influence is the nonsensical meme-investing reality we find ourselves in today: Elon Musk’s tweets moved bitcoin and dogecoin prices by significant amounts within minutes.

If anything, this points to excessive market manipulation by a small group, and by extension, it casts doubts on the genuineness of the NFT boom.

What does the future hold?

Digital artists may end up having to navigate the difficulties and costs of gatekeepers in the future, the same way real-world artists do today. But there may be a useful model for NFT art, Kevin Kelly’s 1,000 True Fans (h/t Chris Dixon):

To be a successful creator you don’t need millions. You don’t need millions of dollars or millions of customers, millions of clients or millions of fans. To make a living as a craftsperson, photographer, musician, designer, author, animator, app maker, entrepreneur, or inventor you need only thousands of true fans.

To be sure, the concept of monetizing one’s fans has been around for a while. Many non-blockchain solutions and platforms that serve this model today like: Kickstarter, Patreon, Indiegogo, and the many photo selling sites. NFTs may end up being an additional tool in the mix.

More bullish NFT use-cases can be found in sports where the likes of NBA Top Shot (NBA video moments) and Sorare (football/soccer cards) essentially sell and facilitate the trading of licensed digital merchandise. Sports fans are no strangers to collectibles and fantasy sports. NFTs offer a logical extension from today’s sports experiences.

Likewise, NFTs within metaverses are a logical extension of today’s gaming experiences, where gamers are used to and expect to buy and trade things for their avatars.

Some NFT use-cases will endure more than others, and along the way, the cryptocurrency price rollercoaster will flush out the remaining unsustainable projects.

Sources:

The Crypto Price-Innovation Cycle, Andreessen-Horowitz.

CryptoKitties Sales History Data, NonFungible.com.

Bitcoin Whales’ Ownership Concentration Is Rising During Rally, BNN Bloomberg.

This article was first published on my Substack page on March 31, 2021.